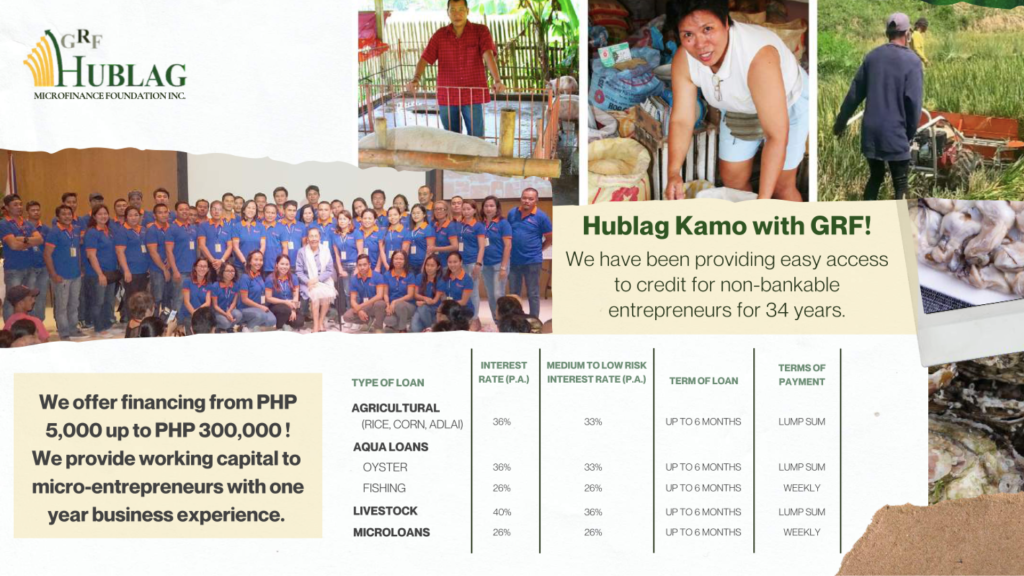

Providing easy access to credit for non-bankable entrepreneurs

Agri/Aqua Based Loans (ABL)

We offer financing from PHP 5,000 up to PHP 300,000! We provide working capital to micro-entrepreneurs with one year business experience.

Frequently Asked Questions

What types of agricultural or aquaculture projects are eligible for loans from your organization?

Rice Farming, Corn, Adlai, Hito, Oyster, Green shell or mussels production.

How do I apply for an agricultural or aquaculture loan with your NGO?

Kindly contact us (036) 520-7185 or visit our office at 2502 Burgos Street Ilawod, Roxas City, Capiz.

What are the eligibility criteria for borrowers seeking agricultural or aquaculture loans?

Must have at least 1 hectare Riceland, 64 years old below and have other source of income.

Tenants are also eligible for loan.

What documentation and information will I need to provide as part of the loan application process?

You will need 2 valid IDs with 3 specimen signatures, Brgy. Clearance, Farm certificate and proof of income.

What is the maximum and minimum loan amount that I can apply for?

15,000.00 per Hectare up to 300,000.00.

What is the interest rate for agricultural or aquaculture loans, and how is it calculated?

36% per annum / 33% for 3rd loan cycle (Rice , adlai, oyster, & mussels,)

What is the loan repayment term, and are there flexible repayment options available?

Rice Lumpsum 4 months

Corn Lumpsum 5 months

Can I apply for a loan if I have a low credit score or no credit history?

Yes! It will undergo credit and background investigation.

Risk Assessments

Are there any collateral requirements for agricultural or aquaculture loans?

If needed.

How long does it typically take to receive a loan decision after applying?

3 to 5 days upon submission of complete documents.

What can I use the loan funds for within my agricultural or aquaculture project?

Farm inputs and Aqua inputs.

Are there any specific training or support services provided to borrowers to enhance their project's success?

Yes! We provide support training (EDT)

Can I apply for additional loans in the future if my project expands or requires further investment?

Yes!

What happens if I encounter difficulties repaying the loan? Are there any grace periods or options for loan restructuring?

No!

Are there any penalties or fees associated with early loan repayment?

No! We give discount for early payments 11 days and more.

How does your NGO assess the potential impact of my agricultural or aquaculture project on the community or the environment?

We promote organic and non-synthetic fertilizers.

Are there any restrictions on the geographic areas where you provide loans?

Yes! Because we have branches all over Panay with respected areas covered.

Do you offer any insurance or risk mitigation services for agricultural or aquaculture projects?

No! But we give life insurance.

What happens in case of natural disasters or unforeseen circumstances affecting my project's viability?

We offer no penalties & condonation.

How can I get in touch with your organization if I have more questions or need assistance with my loan application?

Just visit the nearest branches we have.