CATALYZING SOCIO-ECONOMIC MOBILITY IN PANAY COMMUNITIES

Who We Are

GRF Hublag Foundation, Inc. is the development finance program of the Gerry Roxas Foundation. Hublag, a local term for “a movement,” opens access to economic opportunities by serving the micro credit needs of communities in Panay Island, particularly in agricultural areas. Among Philippine microfinance NGOs, GRF Hublag is recognized for its unique approach of lending to individual micro-entrepreneurs.

The GRF Hublag mission is to organize, equip, and strengthen the economically active poor with skills and capital to “move” them and become sustainable and effective agents of community

development.

GRF Hublag aims to assist clients achieve financial sustainability through yearly improvements in income or assets and their graduation from micro-enterprise to small business.

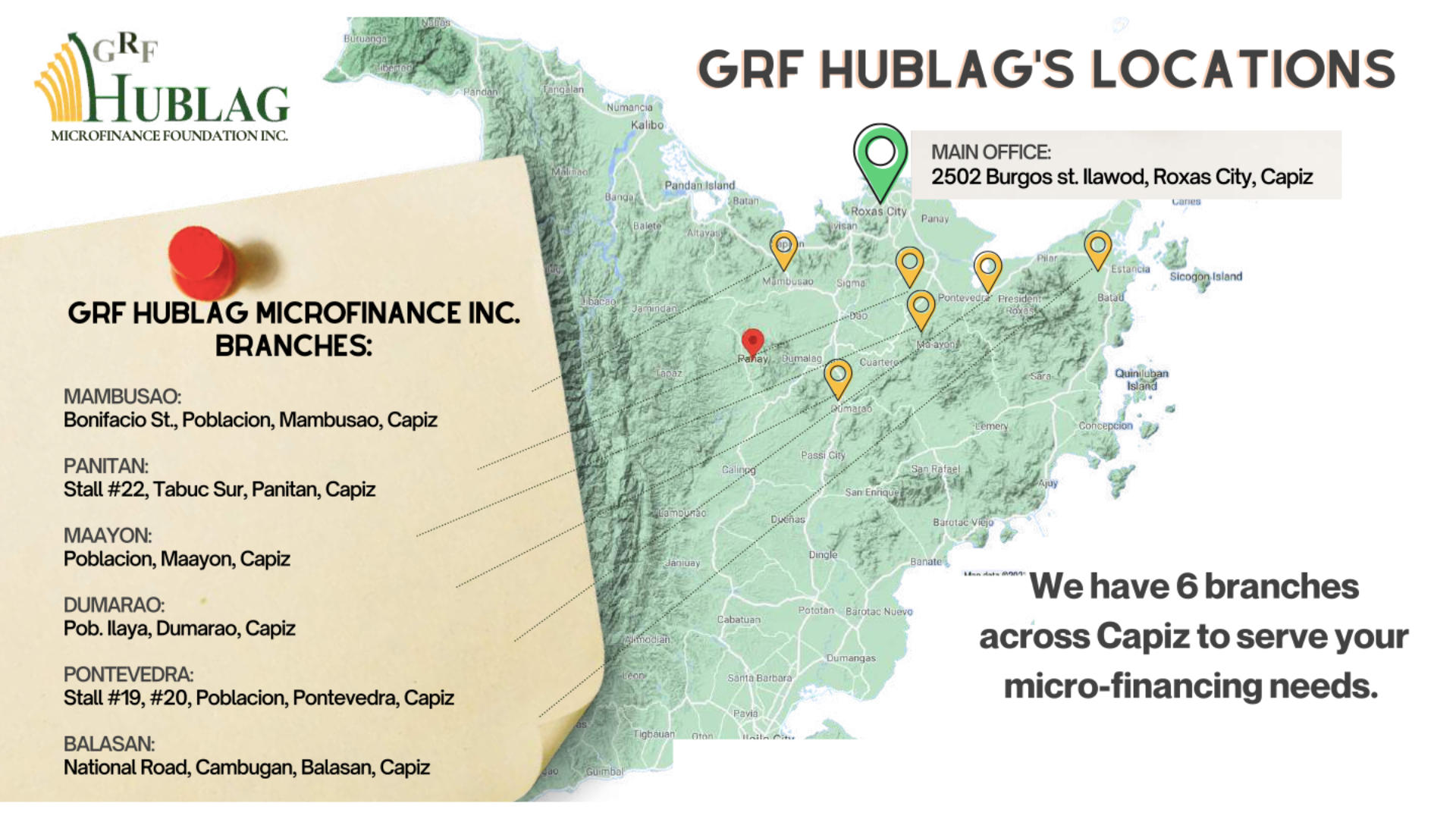

Our locations

Our History

GRF Hublag began operations in 1987 with P500 loans for the working capital needs of 500 non-bankable micro-entrepreneurs. Today, Hublag microcredit operations evolved to five service windows to respond to the credit needs of a wider range of clients. It serves over 3,500 partners through a network of 7 branch offices in 16 towns with an outstanding loan portfolio of P 54.31 M.

GRF Hublag‘s UNIQUE advantage to provide financial support and ready market access.

GRF Hublag’s holistic approach to assure our partners of a sustainable relationship.

Our VISION

A people’s movement for people’s development

Our mission

To organize, equip and strengthen the economically active poor

with skills and capital to “move” them and become sustainable and effective

agents of community development.

Our GOALS

1. Sustainability for both partners and Hublag

2. Outreach to more productive poor partner and diverse economic activities